how to avoid capital gains tax florida

By Florida Independent April 8 2019 5 minute read 0 Table of Contents 1. The long-term capital gains tax rates are 0 percent 15.

Capital Gains On Selling Property In Orlando Fl

A final way to avoid capital gains tax is to hold real estate within a self-directed IRA.

:max_bytes(150000):strip_icc()/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

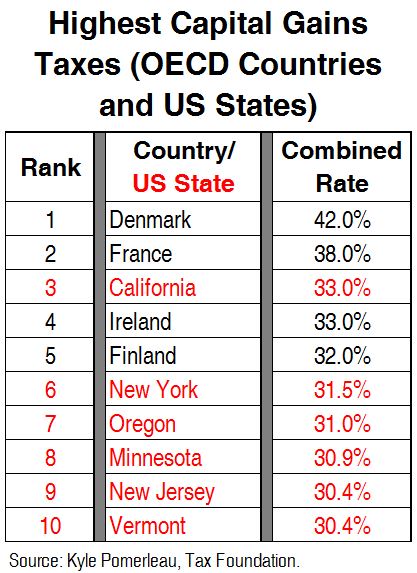

. 500000 of capital gains on real estate if youre married and filing jointly. The states with no additional state tax on capital gains are. At the federal level and in some states these are taxed at.

Taxes will be owed on. Utilize O-Zones to Avoid Capital Gains Tax. Nine states do not charge capital gains taxes.

There are several strategies you can implement that can help you avoid or minimize capital gains taxes. Check for Exemptions 2. The IRS typically allows you to exclude up to.

What is Capital Gains Tax. Filing and paying Florida capital gains tax isnt necessary since Florida doesnt have state-specific rules. Use the main residence exemption.

Since 1997 up to 250000 in capital gains 500000 for a married couple on the sale of a home are exempt from taxation if you meet the following criteria. Key ways to avoid capital gains tax in Florida Take advantage of primary residence exclusion. According to the IRS you can avoid capital gains tax in Florida under specific conditions.

It lets you exclude capital gains up to 250000 up to 500000 if. This allows you to sell the. It depends on the property type and your tax filing status.

It depends on how long you owned and lived in the home before the sale and how much profit you made. Your primary residence can help you to reduce the capital gains tax that you will be. Taking another scenario the allowed exclusion on a 300000 gain for a single filer is 250000.

You have lived in the home as your. You would owe capital gains taxes on 190000 the difference between your purchase price and your sale price. From the above example the 63000 is an allowed exclusion.

These are the same. Long-term capital gains that is. If you have funds in an old 401 k or IRA you can roll them over to a self-directed IRA.

How to Avoid Florida. How do I avoid capital gains tax. If you owned and lived in the place for two of the five years before the sale then up to.

However you must send federal capital gains tax payments to the IRS. Here are four of the key strategies. Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming.

250000 of capital gains on real estate if youre single. Secondly if you are selling a rental property or an investment property you may be able to avoid capital gains tax altogether by doing a 1031 exchange. If you sell rental or investment property you can avoid capital gains and depreciation recapture taxes by rolling the proceeds of your sale into a similar type of.

Long-term capital gains taxes on the other hand apply to capital gains made from investments held for at least a year. If the property you are selling is your main residence the gain is not subject to CGT. Hold onto taxable assets.

You sell it today for 450000. However in the most basic sense capital gains tax is money. Long-term capital gains tax is a tax applied to assets held for more than a year.

The states are Alaska Florida New Hampshire Nevada South Dakota Tennessee Texas Washington and Wyoming. An accountant is your best bet when it comes to explaining capital gains tax. Live on the Property and Sell Often 3.

What is the capital gain tax for 2020.

Guide To The Florida Capital Gains Tax Smartasset

Long Term Capital Gains Tax What It Is How To Calculate Seeking Alpha

Short Term And Long Term Capital Gains Tax Rates By Income

Here S How Stock Trading Profits Are Taxed Money

Foreign Capital Gains When Selling Us And Foreign Property

State Taxes On Capital Gains Center On Budget And Policy Priorities

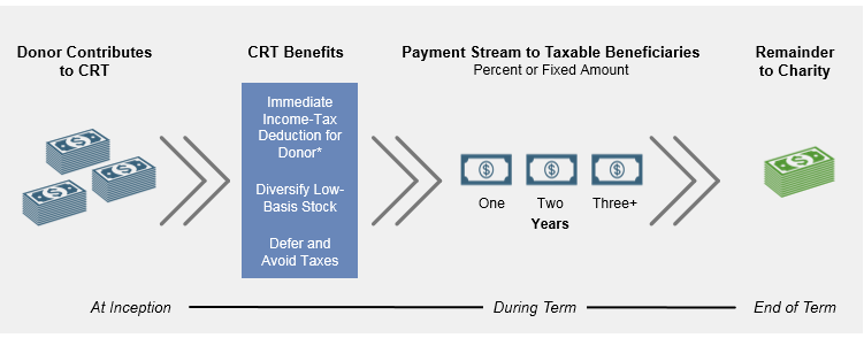

Charitable Remainder Trust Crt Florida House Dc

How To Pay 0 Capital Gains Taxes With A Six Figure Income

How To Avoid Capital Gains Tax When Selling Your Home

The Billionaires Income Tax Is The Latest Proposal To Reform How We Tax Capital Gains Itep

How To Avoid Capital Gains Tax When You Sell A Rental Property

How To Avoid Capital Gains Tax On Rental Property In 2022

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

How To Avoid Capital Gains Tax On Stocks Smartasset

Guide To The Florida Capital Gains Tax Smartasset

Capital Gains Taxes Explained Short Term Capital Gains Vs Long Term Capital Gains Youtube

Can I Avoid Capital Gains Tax When I Sell This Home Njmoneyhelp Com

Capital Gains Tax In The United States Wikipedia

Tax Tips For Selling A House In Florida Florida Cash Home Buyers